7 Key trends impacting the automotive market in the next 5 years

Being a writer of thought leadership content for a mix of IT clients serving different markets as well as the automotive sector provides some unique perspectives. One of those is that the automotive market is, to some extent at least, a microcosm of what’s going on globally. IT-inspired change and the need to find greener ways of living on this overcrowded planet are the most powerful disruptors of our time and the automotive world is in the eye of both of these powerful forces for change simultaneously.

There is no doubt that this presents unique challenges for companies serving Original Equipment Manufacturers (OEMs) and all businesses in the supply chain, most notably car dealerships. We’ve been writing about these changes, working with a number of software clients serving the automotive market, for more than 10 years now.

So, we thought it made sense to publish our ‘Top 7 Disruptive Forces in Automotive’. We have measured these based on the consistent, growing and disruptive presence over at least five years and weighted them by likelihood that they will continue disrupting the automotive sector over the next 10 years or more.

1. Electrification

Next year looks set to be the breakthrough year for Electric Vehicle (EV) sales. Just 13,597 pure Battery-powered Electric Vehicles (BEVs) new registrations were logged in 2017. But take a look at where BEVs are in the first nine months of 2019: annual sales of BEVs is on course to be more than double 2017’s sales – already 25,097 have been sold this year – that’s 122% growth on the same period a year ago. If you look across all types of EV (BEV, PHEV, HEV and MHEV) 2019 sales to date, the data shows that nearly 9% (164,276 vehicles) of all new vehicle sales in the UK are EV (Source: SMMT). So EV is growing against a backdrop of new vehicles sales which are on course to be 3% down on last year. Jaguar Land Rover (JLR) catapulted itself into the ‘electrification revolution’ by launching the Jaguar I-PACE to wide acclaim last year. It followed that success by announcing that from 2020 all its new models will be electrified. Most major brands are set to release EVs over the next 12 months if they haven’t done so already.

Once the majority of fully-charged EVs can hold over 400 miles of charge – 80%+ recharging times have been reduced below 30 minutes; and hundreds of thousands more rapid charging stations have been installed on city streets, in petrol stations, car dealerships, shopping centre and hotel car parks – we could see market take-up accelerating to perhaps exceed 50% of all new vehicle sales within 10 years. It means big changes for Service Centres which depend heavily on oil change-related margins but also its massive disruption for OEMs as Research and Development (R&D) investment has to be redoubled right now in the face of plummeting diesel sales (down more than 20% this year compared to same period in 2018) and petrol sales are at best stable.

2. Autonomous Vehicles

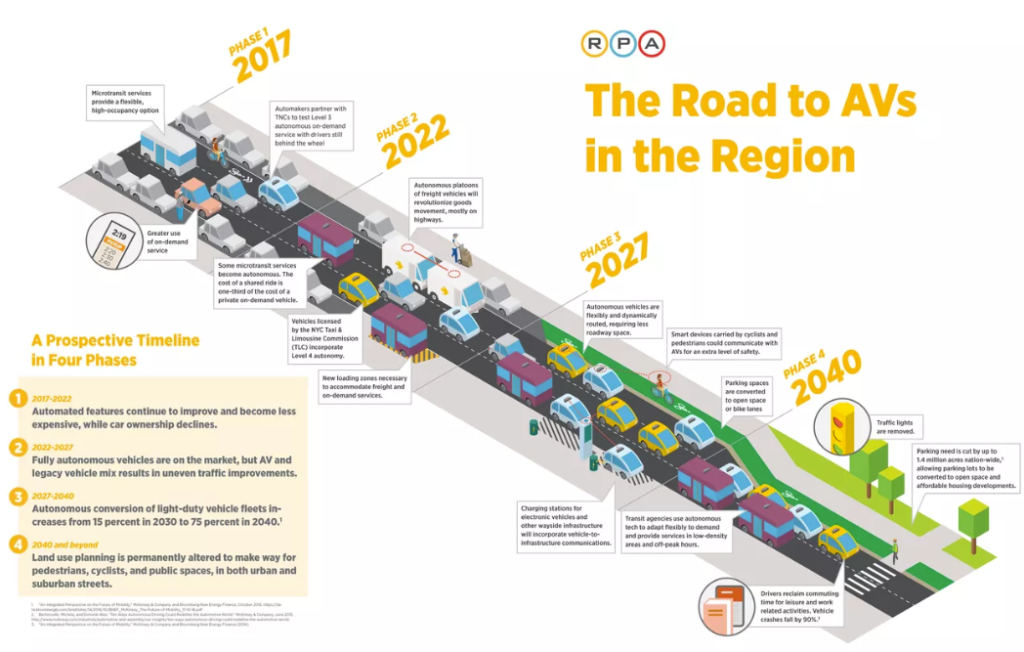

Car manufacturers have been busily laying out their product development plans for Level 3 (‘eyes-off’) and Level 4 (‘mind off’) classes of autonomous vehicles (AVs) and subtly staking their claims for a share of the AV sales opportunity. Motorists will realise that AV doesn’t necessarily mean their exclusion from the driving experience. AVs can allow them can take control as and when their journeys allow. Either your car can drive itself for a large part of a motorway-based commute (Level 3), say, or it drives itself almost entirely, provided you live in a specific geo-fenced urban area (Level 4). Understanding this intervention option should overcome inhibitions held by car buyers uneasy about letting go of the wheel.

A significant area of focus for OEMs focused on AV development is in autonomous taxi services in major cities. Growing urban densities mean car ownership is becoming a rarer privilege. So, increasing numbers of city dwellers will give up car ownership altogether, as driverless cab fleets offer more convenient alternatives to traditional taxis. Uber will be running Autonomous Taxi Service pilots in 13 cities throughout the US by 2022. It is currently burning through $20m per month on developing AV technology. But as you can see below the direction of travel towards AV adoption is already mapped out (Source: RPA).

3. Connected Cars

Another disruptor development that I’ve written about a lot over the last few years is the arrival of the Connected Car – essentially connecting cars to the internet with everything that this could mean in terms of data collection, analysis and service provision based on the resulting insight. Chip vendor Intel estimates that the average Connected Car is already generating over 4,000GB of usage data per hour. As we transition to fully autonomous driving and need to collect and analyse multiple sensor and LiDAR data then, the next generation of vehicles could generate 5,100TB of data each year. According to consultants McKinsey, the overall revenue on offer from monetising this driving data could reach $750 billion globally by 2030.

McKinsey predicts there will be 380m Connected Cars on the world’s roads by the end of 2021. Tesla already uses its drivers’ data to cut their motor insurance premiums by up to 30% (only on Tesla cars sold in California right now). The rich driver behaviour data, combined with location tracking, enables them to assess accident risk, theft and averages speeds more accurately, and to price motor insurance accordingly. It taps into and analyses Tesla driver data to deliver driving behaviour insights and personalised experiences directly to their drivers.

Meanwhile, new BMW drivers are being offered a BMW CarData service via its ConnectedDrive customer portal. BMW CarData promises BMW dealers, once they’ve obtained the customer’s data permission, access to general status, mileage level and service requirements data which can then be used to send servicing alerts to the customer, proactively offering part changes before they wear out and much more.

As well as franchise dealerships, it’s also possible for insurance companies, fleet managers and other authorised third parties to register with BMW CarData, so that many of the benefits mentioned above may be offered via the manufacturer itself if you buy a new ‘connected’ BMW.

The Connected Car revolution feels like a race for who will gain the most control of drivers’ data, derive most insight from that data and deliver the most valuable services back to the customer. At the moment this trend is OEM-driven but there is no reason why dealerships should not join the data goldrush as data volumes build over the next two to three years.

4. Mobility as a Service

The Mobility as a Service (MaaS) trend has been building steadily for over five years now. The premise behind MaaS is that the automotive world needs to respond to the buying habits of a new generation of always-on (the internet) customers called Millennials. Strictly aged 15 to 37 today, this generation tend to buy most of their services via monthly subscription – from mobile phone usage to Netflix, Spotify and Amazon Prime. Why would they not do the same with vehicle usage, renting by the day or perhaps by the month as required via a fully bundled service sold via the internet and delivered to your door?

A number of MaaS providers have popped up to serve car dealerships wanting to derive revenue from any under-utilised forecourt stock. One such is Drover. Drover offers dealers the opportunity to earn an income on pre-registration, ageing, demonstration, used and existing rental stock. Dealers simply need to decide what types (age, model etc) vehicles they are able to make available to Drover and at which price monthly, building in maintenance liability into that figure. They retain ownership of all cars they offer for usage via Drover. Dealers then provide their stock feed to Drover for uploading and online promotion at full bundled prices once Drover has added its sales commission and its insurance estimate.

MaaS is also a great way for dealers to reach the younger buyer market which many dealers struggle with. Several major OEMs have rolled out their own subscription-based offerings in the US including BMW, Volvo, Fiat Chrysler and Chevrolet. Volvo is trialling its ‘Care by Volvo’ subscription-based service in the UK. It’s definitely a trend that’s worth a closer look as is the public-private integrated Mobility as a Service plans being built at a city, region, national and EU-wide level.

MaaS also offers a regular subscription-based income stream. Dealers no longer need to rely solely on new car sales or servicing income which can fluctuate – some quarters are good but others less so. This fluctuation can of course stimulate excessive vehicle pre-registration.

5. Tighter Regulation

Regular monthly MaaS-based subscription revenue from under-utilised stock may need to supplement or replace some monthly subscription-based Finance and Insurance-based (F&I) income. Most vulnerable right now is income from Guaranteed Asset Protection (GAP) insurance sales. GAP sales fell between 16 and 23% following the Financial Conduct Authority’s (FCA) intervention in this market in September 2015. Tighter regulation of motor finance is also heading dealers’ way as the FCA begins scrutinising Difference in Charges (DiC) sales commission arrangements on PCPs and forces through increased professionalism standards as part of Senior Manager’s and Certification Regime (SMCR) going live this December.

It’s also worth remembering that it’s less than one and half years since ‘GDPR Day’ which, our research revealed, led many UK car dealers to go down the ‘double opt-in’ route, forcing them, unnecessarily on reflection, to delete up to three-quarters of their customer records.

6. Cyber Security

As cars increasingly resemble mobile super computers, the risk and dangers of being hacked have also increased exponentially. There are definitely roles for cyber security professionals inside dealerships, OEMs and components manufacturers in the supply chain. We predict that within the next five years, car vendors will be able to differentiate themselves or fatally damage their reputations if they don’t get cyber security right. Having a great reputation for safety is of paramount importance for all vehicle manufacturers. There will be more spent on hardening the operating systems and securing data feeds running in and from vehicles than OEMs currently spend on improving physical safety of drivers today.

7. Rise & Rise of Digital Sales

Finally, it’s worth remembering the inexorable drive towards doing more business digitally. Dealers are shifting more and more stock via their own websites and intermediaries like Auto Trader, CarGurus and CarWow. So much so that one of the more successful dealer groups, Peter Vardy has already set a target of reaching that tipping point of 50% of all car sales to be completed digitally in 2023 – that’s in just four years’ time. Digital marketing skills are becoming the big skills area which everyone is recruiting for and they are increasingly the most over-subscribed workshops at industry events like AM Live.

Summary

This list is far from exhaustive, we haven’t even got into the impact of Artificial Intelligence (AI) which is set to influence the adoption of quite a few of the above trends in the next five years. Wherever big data sets are present (see #3 above) AI and machine learning will be put to work to crunch it and deliver insights back to owners of the data. Dealers and OEMs alike will be recruiting data scientists to set up and manage the algorithms which deliver the crucial insights which ensure that the manufacturers, dealerships and service centres stay sharp, relevant and thriving in this increasingly tech-led world.

Author: Miles Clayton

Published: 16 October 2019

Recent Comments